Naturgy today presented its 2025 results, which demonstrate the company’s ability to deliver on all its commitments—despite an energy environment that deteriorated in the second half of the year. Net profit reached 2.023 billion euros, investments exceeded 2.1 billion euros, the company’s contribution to society in taxes and fees amounted to nearly 1.3 billion euros, and dividends distributed to shareholders totalled around 1.7 billion euros.

Naturgy has today presented to the market its Strategic Plan for the 2021–2025 period, in which the company will strengthen its role in the energy transition and decarbonisation. Through this plan, Naturgy has set out the main lines of industrial and financial action for the coming years in an energy context of profound transformation and after a year marked by a macroeconomic crisis that has greatly impacted the sector.

Naturgy has concluded the sale of its electricity network business in Chile to the state company State Grid International Development Limited (SGI), following the successful completion of the tender offer launched by State Grid, as a necessary and final step to complete the transaction.

Today Francisco Reynés, Naturgy chairman, and Toufik Hakkar, Sonatrach chairman, agreed that the Medgaz expansion would start operations in the autumn. The companies held a work meeting in Orán (Algeria) as part of a visit to Medgaz. The agreement will see the gas pipeline expand its capacity by 2 bcm/year, representing an increase of 25%, reaching 10 bcm/year from the fourth quarter onwards.

Telstra and Naturgy, through its international power generation subsidiary Global Power Generation (GPG), announced today they have signed a power purchase agreement (PPA) to build a 58 megawatt (MW) wind farm located near Goulburn in New South Wales. The wind farm, called Crookwell 3, will commence construction in the last quarter of 2021 and is expected to be fully operational in the first half of 2023. GPG will invest approximately AUD120 million (equivalent to approximately €76 million) to develop the Crookwell 3 wind farm.

This week Naturgy has become the first company to inject renewable landfill gas into Spain’s gas distribution network. A landmark that reflects the company’s commitment to the energy transition and positions it at the forefront of innovation in developing this new energy vector, which will make a significant contribution towards decarbonising the country’s energy system.

Naturgy closed the first quarter of 2021 having made significant progress in its commitments to long-term value creation for all its stakeholders and risk profile reduction. The company continued to actively manage all its businesses during the period, finalised an agreement to settle disputes amicably in Egypt and took decisive steps towards concluding the sale of its electricity distribution business in Chile, scheduled for the second quarter of this year. Naturgy also maintained its drive to improve its position in the international renewable energy market; January saw it conclude its operations to enter the US market by purchasing a portfolio of projects in the initial development phase.

Naturgy Chairman and CEO, Francisco Reynés, chaired the company’s Ordinary General Shareholders’ Meeting, held today in Madrid online as a result of mobility restrictions and to maintain safety due to Covid-19. Shareholders approved the company’s results and management report for 2020, as well as a complementary dividend of €0.63/share, which will be paid on 17 March.

Cleantech Camp, the programme that focuses on accelerating the energy transition in Europe, is celebrating this year its 6th edition. Throughout the month of March, startups that are developing projects related to clean energy will be able to submit their applications to enter into a selection process that will allow up to 15 emerging companies from different European countries to participate in the programme between the months of April and July. The programme is promoted by EIT InnoEnergy, Naturgy, Enagás Emprende, CRH and PRIO, in collaboration with Barcelona Activa (Local Partner) and Bridge the Gap, Osborne & Clarke and ZBM Patents & Trademarks.

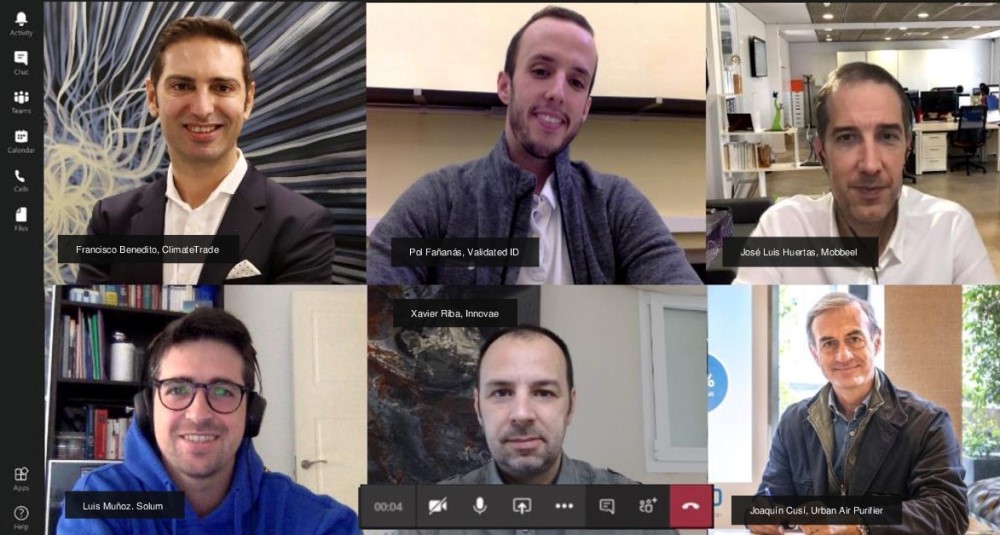

Start4big, the first multisector open innovation initiative promoted by Aigües de Barcelona, CaixaBank, Naturgy, SEAT and Telefónica, has chosen the winning startups of its second Wave of Innovation. In total, six of the 192 proposals submitted reached this final phase, which could involve starting different pilot projects with one of the major companies promoting the initiative. The winners are Validated ID, Mobbeel, Innovae, Solum, Urban Air Purifier and Climate Trade.

Naturgy has signed an agreement with Gestamp in order to secure the consumption of renewable energy in Spain. The agreement will ensure that from 2022 onwards, all the Group´s productive facilities and R&D centers in Spain will operate with 100% renewable energy.

Contact

If you are a journalist and need information about Naturgy operations, you can get in touch with us via prensa@naturgy.com.

Subscribe to our newsletter

Si te interesa el mundo de la energía y el proceso de transformación en el que está inmersa, te invitamos a compartir nuestra visión de futuro sobre los retos de la transición energética.

Subscribe to our newsletter

Si te interesa el mundo de la energía y el proceso de transformación en el que está inmersa, te invitamos a compartir nuestra visión de futuro sobre los retos de la transición energética.